The Office for Budget Responsibility (OBR) has given its latest take on the economy, and it’s full of big changes to its economic projections but also plenty of red flags about the levels of uncertainty around its forecasts.

Echoing the chancellor’s speech in the Commons and the Bank of England last week, the OBR warned there are many policy uncertainties, which has made its job harder.

First, there’s the threat of Donald Trump’s looming tariffs, something the OBR alluded to when describing “a tightening of global trade restrictions”. It also lacks confidence in its assessment of the government’s plan to cut welfare benefits because it has not been given enough time to scrutinise them.

The word “uncertainty” featured more than 50 times in this document.

Money blog: Send us your questions on what spring statement means for you

It means that these numbers could move again, and if they move in the wrong direction, Rachel Reeves could be back in the autumn, scrambling to find more savings to meet her fiscal rules.

Indeed, the OBR warned that her headroom of £9.9bn by 2029/30 is historically small, “only one-third of the average of £31.3bn that chancellors have set aside against their fiscal rules since 2010”.

That headroom would have slipped to – £4.1bn in just the six months since October had the chancellor not done a repair job on Wednesday. It could easily slip again.

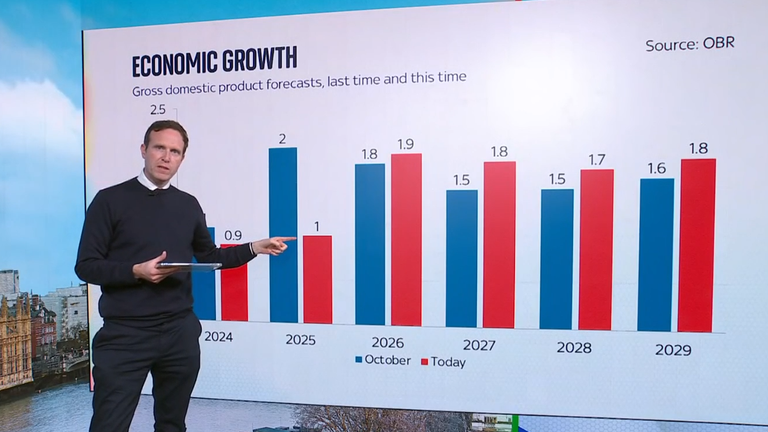

Growth halved

The OBR cut its economic projections for this year, halving growth from 2% to 1%.

Even that is more optimistic than many other forecasters, including the Bank of England, which has the rate at 0.75%.

The chancellor spoke of this as a global phenomenon, but it’s clear business and consumer confidence has slipped at home among concerns about higher business taxes that were announced in the autumn budget.

These are casting a long shadow on the economy, and their real force will be felt from next month when the rises to national insurance contributions kick in.

A better picture for future GDP

A bad year, but the OBR subsequently lifted its growth projections for subsequent years.

GDP growth jumps to 1.9% in 2026 as inflation, interest rates, and gas prices fall back.

Growth averages 1.75% over the rest of the decade, helped by a 0.4 percentage point boost from the chancellor’s planning reforms.

Those reforms will unlock £15.1bn for the public purse.

Ms Reeves said it was the biggest boost to growth the OBR has ever recorded “for a policy with no fiscal cost”. The watchdog said it would help unlock 305,000 new homes a year by the end of the decade, up from a decade low of around 100,000 in 2024.

Productivity down

While it upgraded growth forecasts, the OBR downgraded its productivity projections.

Productivity measures our economy’s performance – the amount of growth it can generate with the resources it has.

Increasing productivity is generally considered to be the key to unlocking better living standards in the long term.

The OBR signalled that Britain’s working population is larger than previously estimated, as are levels of employment.

That’s not being reflected in upgrades to the growth forecast, meaning productivity is lower. It said this would leave productivity 1.3% lower in 2029.

A bumpy boost to living standards

That has also squeezed living standards. Real GDP per capita was 0.7% below the October forecast and 1.1% lower than it was on the eve of the pandemic. However, strong wage growth means it will recover from this year, and disposable incomes will also enjoy a boost.

Labour is celebrating the fact that disposable incomes are up, with households “£500 a year better off under this government” but the OBR warned that it was not a smooth journey to better living standards, with the rise in national insurance contributions as well as higher taxes because of frozen income tax thresholds starting to weigh heavily on disposable incomes by 2027.

It then picks up again as those thresholds are unfrozen.

All of which is to say, there’s a bumpy and uncertain journey ahead.

Nothing underscores that better than this section from the report: “Significant uncertainty surrounds domestic and global economic developments.

“If the projected recovery in UK productivity growth fails to materialise, and it continues to track its recent trend, then output would be 3.2% lower, and the current budget would be 1.4% of GDP in deficit by the end of the decade.

“A 0.6 percentage point increase in Bank rate and gilt yield expectations across the forecast would eliminate current balance headroom.

“And if global trade disputes escalate to include 20 percentage point rises in tariffs between the USA and the rest of the world, this could reduce UK GDP by a peak of 1% and reduce the current surplus in the target year to almost zero.”

#Uncertainty #features #times #Office #Budget #Responsibility #OBR #assessment #public #finances #Money #News

Leave a Reply